An NEP & NSQF Aligned Curriculum

Be a Certified

Wealth Manager

"Become a certified wealth manager" is our flagship course, suitable for undergraduates and graduates who aspire to build a career in wealth management in banks and investment management companies. Our certified wealth manager course covers important topics such as certified financial manager skills and portfolio management strategies. The certified wealth manager course is for you if you want to learn from Certified Financial Planners the best ways to become a wealth manager, asset manager, certified financial manager, or portfolio manager in the BFSI industry.

Total Duration :

30 Hours

Curated by Maxine Guerra & Joe Smith

Curated by

Krishnan Gopalakrishnan

CFA, CFP

Credit Points

University of mumbai credits

Blended Learning

Dive into the self paced videos & Live sessions With Industry Expert

Life Time Access

A learning investment forever.

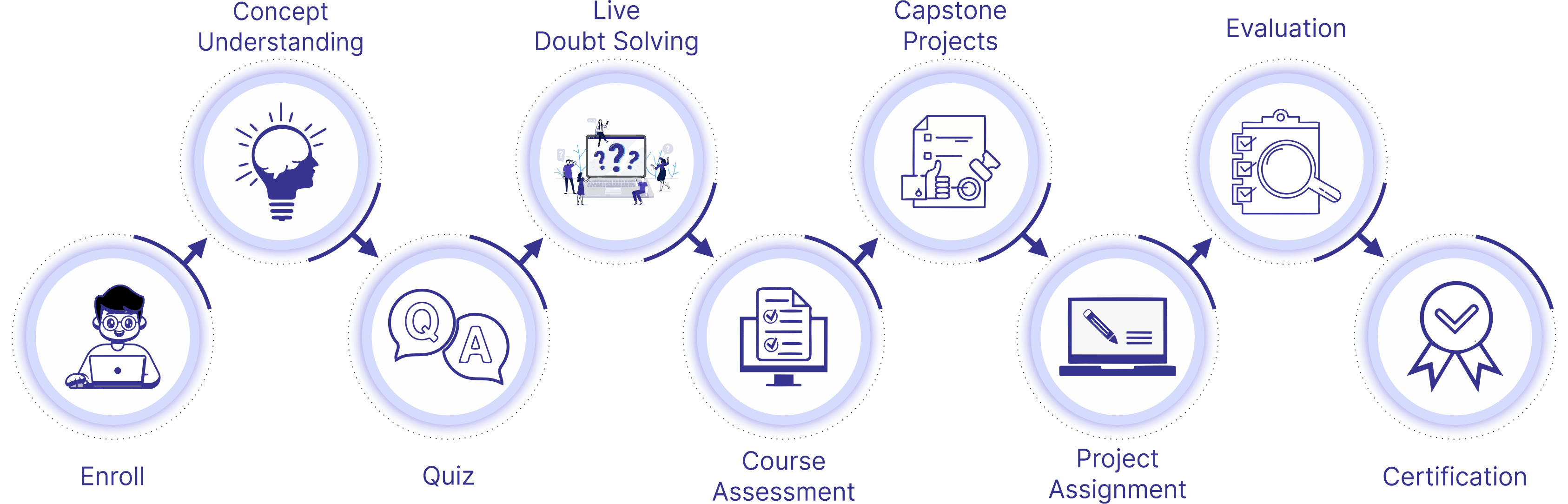

Hunar's Pathway To Success!

Certified Wealth Management Program Highlights

Learn in-demand Skills from Industry Expert

Live Doubt solving session

Mentorship

Mentorship for students

Solve Quizzes & Assignment

Exclusive Job Portal

Industry based case study

Student support

Packages at ₹35k/month

Get the best offers

Best-in-class content for Certified Wealth Management course

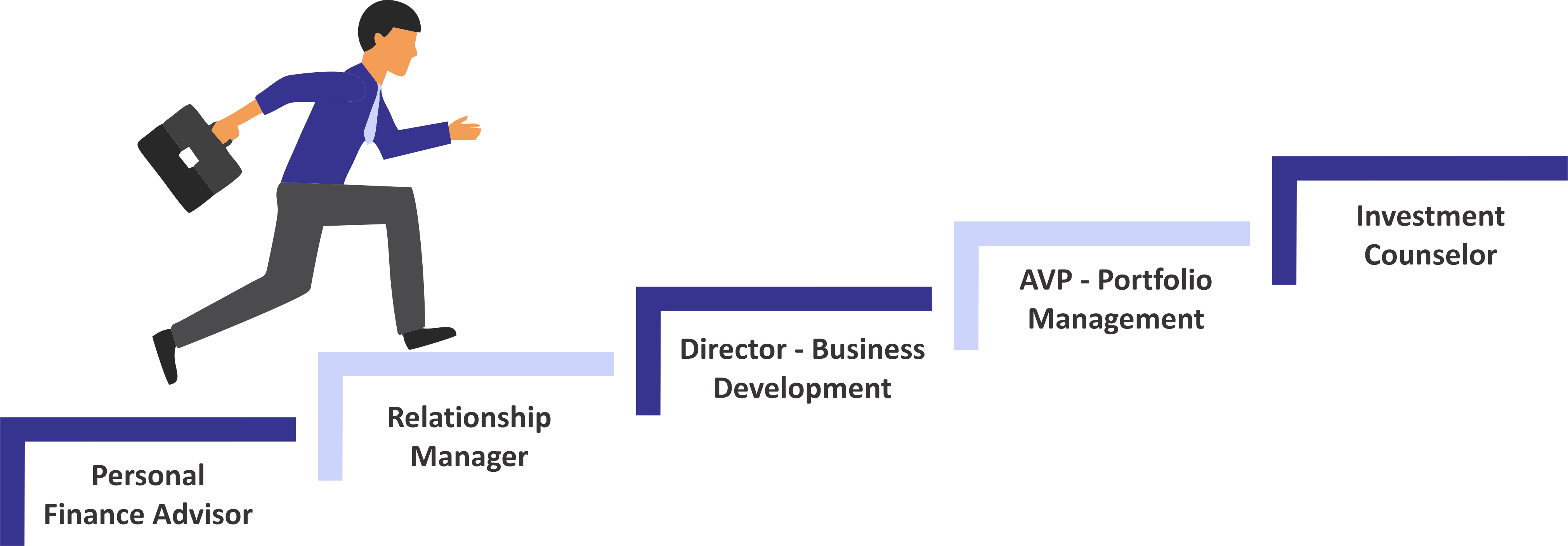

Certified Wealth Manager - Career Path

Companies seeking applicants for Wealth Manager

Industry Recognized Wealth Management Certification

Share your certificate and gain visibility

Get a competitive advantage and a useful certification by enrolling in the “Certified Wealth Manager” program. Showcase your abilities as a wealth manager, asset manager, financial advisor, or consultant to get hired. Attract recruiters and land your first finance industry job.

The learning path to becoming a Certified Wealth Manager

Module 1

Investment Avenues in India

Investment vs Savings

Traditional Investments vs Modern Investments

Small Saving schemes

Chit Funds

Real Estate

Risk Mitigation - Insurance

Financial Markets and Instruments

Indian Capital Market and Regulators

Equities and Corporate Actions

Fixed Income Instruments

Derivatives

Alternative Investments

Mutual Funds

Basic of Fundamental Analysis

Module 2

Private Finance Fundamentals

Overview of Wealth Management

Time Value of Money

Economic

Managing Taxes

Module 3

Portfolio Management

Portfolio Monitoring and Rebalancing

Portfolio Construction & Management

What You’ll Learn

Investment Avenue in India:

- Investment Fundamentals: Understand savings vs. investing, returns, and traditional vs. modern options.

- Investment Avenues: Explore government schemes, real estate, chit funds, and alternative investments.

- Risk Mitigation: Discover how insurance (life & general) protects your finances.

- Financial Markets: Grasp the basics of financial markets, participants, and regulators.

- Investment Instruments: Learn about equities, bonds, derivatives, and their analysis.

- Mutual Funds: Understand how mutual funds work, invest using SIPs, and compare them to ETFs.

Financial Planning: Develop a customized plan that incorporates risk assessment, certified wealth manager insights, asset management, the time value of money, and tax considerations. This approach is crucial for effective portfolio management and private finance strategies, ensuring a well-rounded and secure financial future.

Portfolio Management: Learn how a certified wealth manager, creates, tracks, and enhances your investments for the best possible returns and risk control. Ensure strong private finance procedures and improve your asset management tactics. Efficient risk management and return maximization depend on effective portfolio management.

Know Your Instructor

Krishnan Gopalakrishnan

CFA,CFP

Krishnan Gopalakrishnan is a seasoned professional with more than ten years of experience in both academics and finance. He is skilled at blending theory with practical application. Presently employed as an Adjunct Faculty at Pune’s Dr. D. Y. Patil B-School, he brings expertise to the classroom, nurturing the next generation of finance professionals. As a Freelance Finance Trainer, with a focus on CFA Level 1 instructor he empowers learners through Hunarho.

Eligiblity, learnings and the opportunities

- Undergraduate, Graduate, Post-Graduate, seeking to make a career in Wealth Management to develop competencies related to Personal Financial Planning and Financial Management.

- A working professional with 0-3 years of experience in finance roles.

After completing this program you will possess the following skills / knowledge

- Extensive knowledge about the functioning of Financial Markets

- Risk and Return Evaluation of different Financial Instruments

- Fundamentals of Portfolio Management

- Experience with the tools used in Financial Analysis and Financial Planning

- Application of Economic Concepts in Investments Risk Management using Insurance and Derivatives

- Risk Management using Insurance and Derivatives

- Overview of Fundamental and Technical Analysis used for Analyzing Investments

You may apply for the following job positions:

- Wealth Manager/Financial Advisor

- Private Banker

- Investment Advisor

- Portfolio Manager

- Relationship Manager

- Financial Planner

- Wealth Management Analyst

- Client Service Associate

- Estate Planning Specialist

- Risk Manager

- Insurance Advisor

Learners Support

Fill up the following details

Students Testimonials

FAQs

All aspects of financial planning, investment strategies, asset management, private finance, and portfolio management are covered in detail in a certified wealth management course. It gives people the skills and qualifications required to work as professional wealth managers.

The salary ranges from 3.5LPA to 12LPA based on your prior experiences. A fresh graduate can expect anywhere between 4-8LPA. On average anyone with a certification as a wealth manager can draw around 7.2LPA.

It’s a fantastic career where you use your abilities and expertise to help your clients get wealthier. It’s a high-end financial solution for high-profile individuals who need your experience managing a portfolio and making wise choices.

To work as a wealth manager, you must have a bachelor’s degree. Use internships or entry-level jobs to get experience. A certified wealth management course helps you become more credible and skilled in the industry.

The keys to wealth management include financial expertise, strategic planning, risk management, and personalized client service, ensuring careful investments and effective portfolio management for long-term financial growth.