Be a Retail Banker

Hunarho’s 'Be a Retail Banker' course is a comprehensive training program designed to equip individuals with the necessary skills and knowledge to thrive in the dynamic world of retail banking. Covering a wide array of essential topics, this course delves into customer relationship management, financial products understanding, sales techniques, and banking regulations. With industry-expert-led sessions, real-world case studies, and immersive learning experiences, graduates emerge well-prepared to handle the demands of the retail banking landscape, securing opportunities for rewarding careers in esteemed financial institutions.

Total Duration :

1 Month

Next Batch starts in FEBRUARY

Curated by Maxine Guerra & Joe Smith

Curated by

Ritesh Varma

PHD, MBA

Job Assistance

Get Guaranteed interview by leading industry

Live Sessions

Dive Into Live Session with Industry Expert

BFSI Certification

Get certified by BFSI Sector Skill Council of India

Next Batch starts in JULY

Hunar's Pathway To Success!

Program Highlights

Learn From BFSI Experts

Industry Recognized Certificate

Mentorship

Mentorship for students

Student Support

Exclusive Job Portal

100% Job Assistance

Live Doubt Solving Sessions

Packages at ₹35k/month

Get the best offers

Best-in-class content for the students from Hunarho!

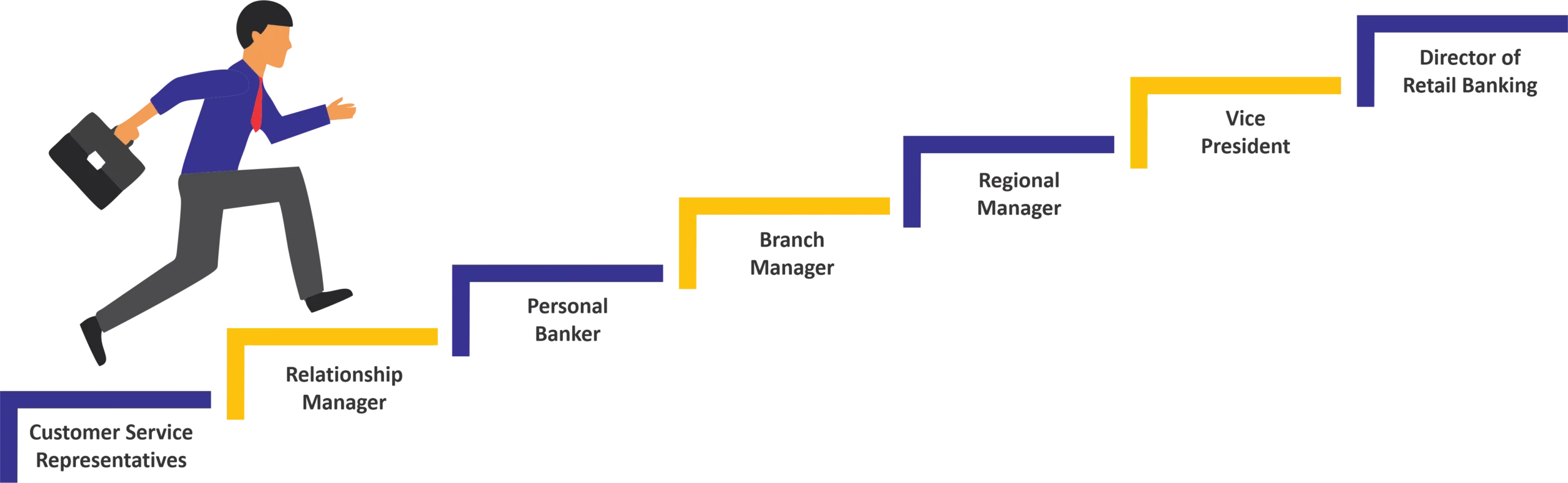

Be a Retail Banker - Career Path

Companies seeking applicants for Retail Banker

Industry Recognized Certification

Share your certificate and gain visibility

- Demonstrate your skills & capabilities

- Acquire a competitive advantage with BFSI certification

- Grab the attention of recruiters

- Take a leap towards your first job

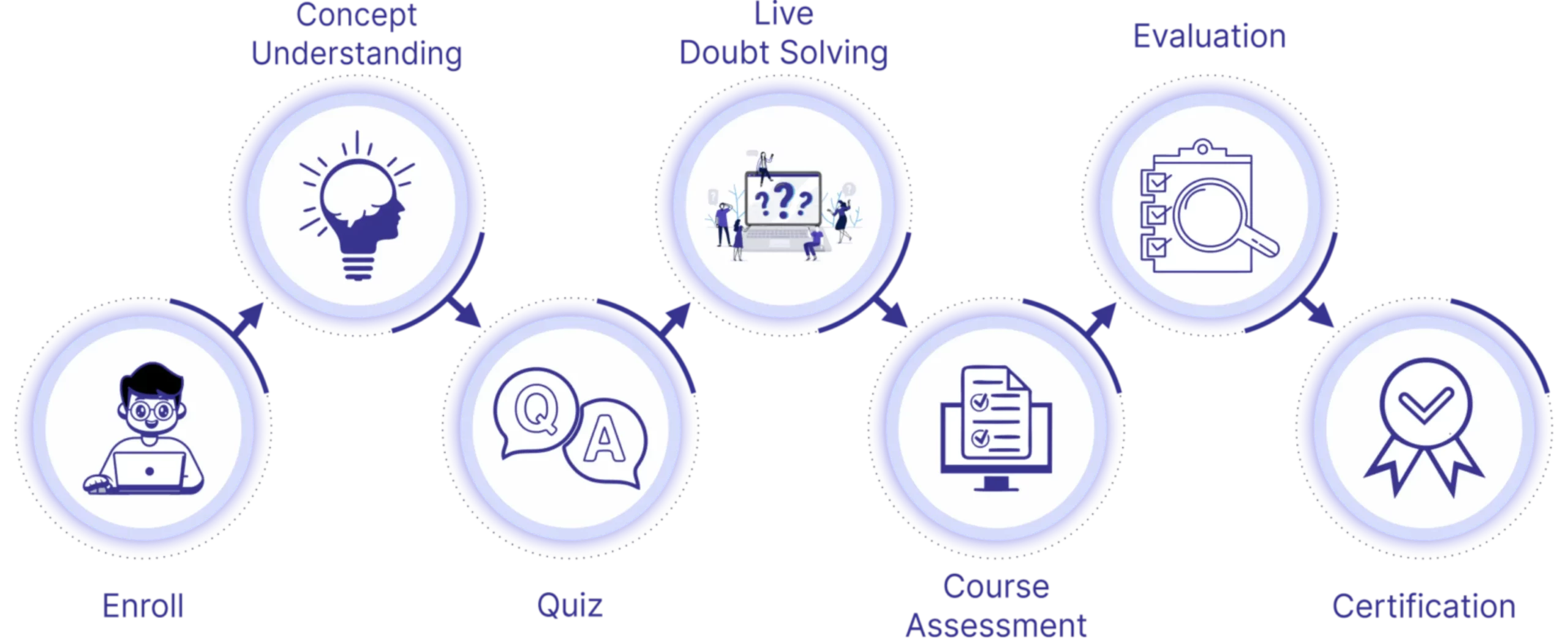

The learning path to the program

Module 1

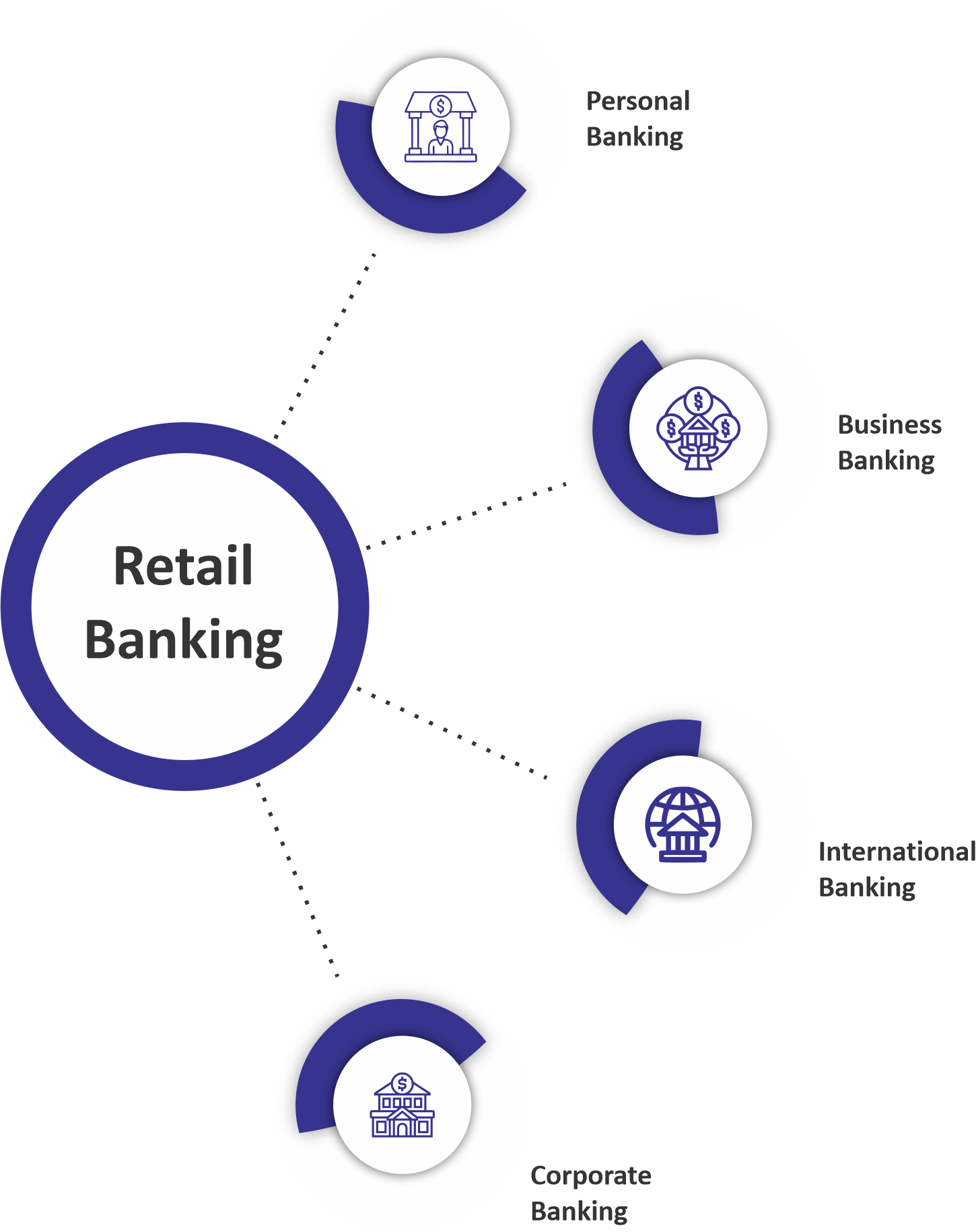

Retail Banking

Introduction to Loans

Type of Loans

Securitization

Renting v/s Buying

Ways not to default

Credit Score

Retail Loans

Revision

Features of Retail Banking

Personal banking : Personal banking refers to the suite of financial services and products that individuals use to manage their money, conduct transactions, and achieve their financial goals.

Business banking : Business banking refers to the suite of financial services and products specifically designed to meet the needs of businesses and corporate clients

International banking : International banking refers to the provision of financial services and products by banks and financial institutions across borders to individuals, businesses, and governments involved in international trade and investment.

Corporate banking : Corporate banking, also known as business or commercial banking, refers to a range of financial services and products provided by banks to corporations, businesses, and other large entities.

Why our students are prepared for the industry?

Program Fee & Financing

Easy Financing Options

Discover seamless financing with Kuhoo: Low interest rates, flexible terms, quick approval, and secure transactions. Make your dreams a reality with our easy financing options today!

Our Finance Partner

Start as low as

No Cost EMI options available

Other Payment Options

We provide the following options for one-time payment

Phonepe /

Google Pay/ Paytm

Internet Banking

Credit/Debit Card

Total Admission Fees

₹ 45,000/-

Limited time offer

Eligiblity, learnings and the opportunities

Bachelor’s degree in a relevant field such as Finance, Economics, Business, Accounting, or a related discipline are eligible for this program.

Here are the list of the things you’ll learn through the program as you progress:

- Understanding of Retail Banking

- Customer Service Skills

- Financial Products and Services Knowledge

- Sales and Relationship Building

- Regulatory Compliance

- Technology and Digital Banking

- Risk Management

- Financial Analysis

- Ethical Conduct

- Teamwork and Collaboration

- Problem-Solving Skills

You are eligible to apply for these job profiles once you complete a program of Be a Retail Banker:

- Teller / Customer Service Representative

- Personal Banker

- Banking Associate

- Financial Services Representative

- Assistant Branch Manager

- Loan Officer Assistant

- Relationship Banker

- Universal Banker

- Banking Specialist

- Financial Advisor (Entry Level)

- Digital Banking Specialist

- Branch Operations Coordinator

Learners Support

Fill up the following details

Students Testimonials