An NEP & NSQF Aligned Curriculum

Certified Retail Banker

"Certified Retail Banker" course equips individuals with the essential skills and knowledge needed for success in retail banking. This course equips you with the knowledge and tools to navigate the world of loans, manage your credit score, and make sound financial choices. Retail Banking majorly caters to personal banking Through expert-led sessions, real-world case studies, and immersive learning, graduates are well-prepared for rewarding careers in esteemed financial institutions.

Total Duration :

30 Hours

Next Batch starts in FEBRUARY

Curated by Maxine Guerra & Joe Smith

Curated by

Ritesh Varma

PHD, MBA

Credit Points

University of mumbai credits

Blended Learning

Dive into the self paced videos & Live sessions With Industry Expert

Life Time Access

A learning investment forever.

Hunar's Pathway To Success!

Program Highlights

Learn in-demand Skills from Industry Expert

Live Doubt solving session

Mentorship

Mentorship for students

Solve Quizzes & Assignment

Exclusive Job Portal

Industry based case study

Student support

Packages at ₹35k/month

Get the best offers

Best-in-class content for Certified Retail Banker Course

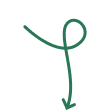

Certified Retail Banker - Career Path

Companies seeking applicants for Certified Retail Banker

Industry Recognized Retail Banker Certification

Share your certificate and gain visibility

Get a competitive advantage and a valuable certification by enrolling in the “Certified Retail Banker” course. Showcase your abilities as a retail banker, financial advisor, or consultant to get hired. Attract recruiters and land your first finance industry job.

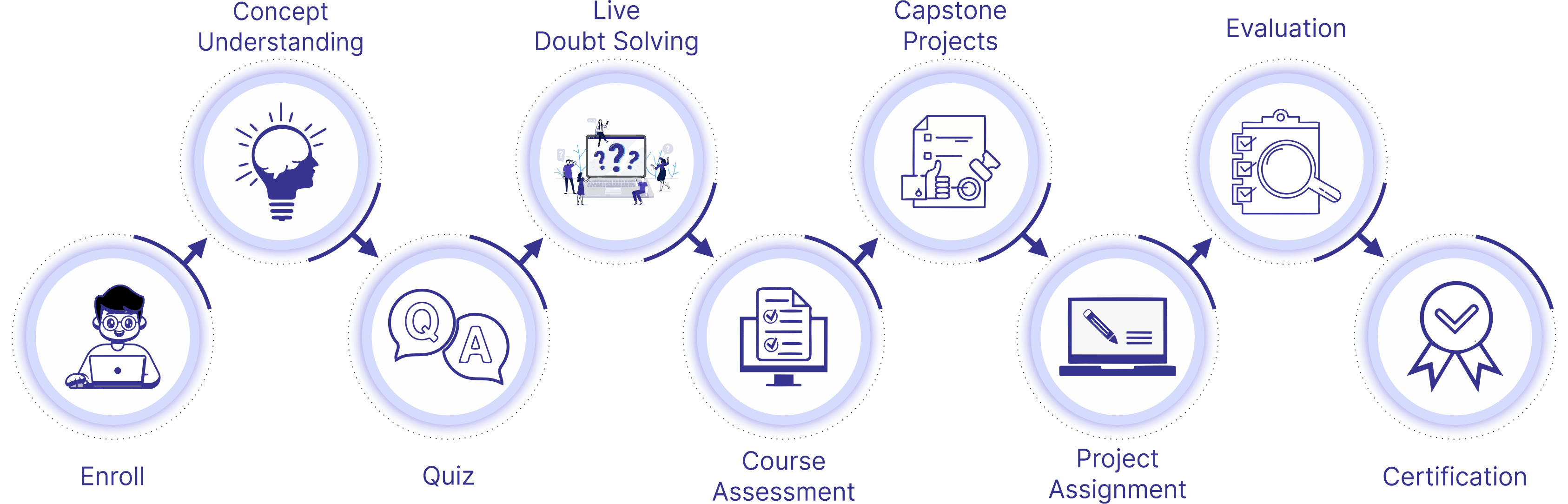

The learning path to the program

Module 1

Retail Banking

Introduction to Loans

Type of Loans

Securitization

Renting v/s Buying

Ways not to default

Credit Score

Retail Loans

Revision

What You’ll Learn

- Loan Fundamentals:

- Demystifying Loans: We’ll explore the concept of loans, delve into secured vs. unsecured options, and explain the role of guarantors.

- Banking System Explained: Gain insights into the structure of the Indian retail banking sector, the products and services they offer, and KYC compliance.

- Understanding Financial Liabilities: Learn about fixed deposits, current accounts, savings accounts, and flexipay options.

- Loan Products Deep Dive:

- Personal Loans: We’ll unpack eligibility criteria, types of personal loans, their limits, advantages, and disadvantages.

- Home Loans: Master the different home loan options, including those for under-construction properties, ready-to-move homes, renovations, and reconstructions.

- Vehicle Loans: Understand the nuances of car loans and two-wheeler loans.

- Education Loans: Equip yourself with knowledge of education loan processes and considerations.

- Credit Cards: Learn the ins and outs of credit cards, including their types, benefits, and responsible usage.

- Beyond Loans:

- Securitisation Explained: Discover the concept of securitisation in the loan market.

- Legal Aspects of Borrowing: Understand the legal framework surrounding mortgages, hypothecation, pledges, liens, and assignments.

- Renting vs. Buying: We’ll explore the financial implications of renting and buying a property, with calculations and graphs to aid your decision-making.

- Credit Management:

- Credit Score Demystified: Learn what credit scores are, how they’re calculated, and the factors influencing them.

- Strategies for a Healthy Credit Score: Discover effective ways to improve and maintain your credit score.

- Financial Security:

- Insurance Fundamentals: Get introduced to insurance products and services, KYC norms, and legalities.

- Bonus Module:

- Introduction to Indian Capital Markets: Gain a basic understanding of investments and available products.

Know Your Instructor

Ritesh Kumar Verma

PHD, MBA

As an Associate Professor at Pune Institute of Business Management, He specializes in Financial Modeling, Risk Management, and Commercial Banking. His professional background includes positions as an assistant professor at RK University and the Narsee Monjee Institute of Management Studies at SVKM. With hands-on experience in banking operations, credit analysis, and retai banking. Mr. Varma brings a comprehensive understanding of finance to both teaching and industry practice.

Eligiblity, learnings and the opportunities

- Undergraduate, Graduate, Post-Graduate, seeking to make a career in Wealth Management to develop competencies related to Personal Financial Planning and Financial Management.

- A working professional with 0-3 years of experience in finance roles.

Here are the list of the things you’ll learn through the program as you progress:

- Understanding of Retail Banking

- Customer Service Skills

- Financial Products and Services Knowledge

- Sales and Relationship Building

- Regulatory Compliance

- Technology and Digital Banking

- Risk Management

- Financial Analysis

- Ethical Conduct

- Teamwork and Collaboration

- Problem-Solving Skills

You are eligible to apply for these job profiles once you complete a program of Be a Retail Banker:

- Teller / Customer Service Representative

- Personal Banker

- Banking Associate

- Financial Services Representative

- Assistant Branch Manager

- Loan Officer Assistant

- Relationship Banker

- Universal Banker

- Banking Specialist

- Financial Advisor (Entry Level)

- Digital Banking Specialist

- Branch Operations Coordinator

Learners Support

Fill up the following details

Students Testimonials

FAQs

Retail banking, sometimes referred to as consumer banking, is the term used to describe the services that financial institutions offer to individual clients. It covers a wide range of goods and services, including credit cards, mortgages, bank and savings accounts, and personal loans.

- Personal Accounts: Retail banks offer personal accounts for day-to-day banking needs, including savings accounts, current accounts, and fixed deposits.

- Consumer Loans: Retail banks provide loans for personal expenses, such as home loans, car loans, and education loans.

- Credit Cards: Retail banks issue credit cards for purchasing goods and services on credit.

- ATMs and Online Banking: Retail banking relies on ATMs and online platforms for convenient access to banking services.

- Branch Network: Retail banks have physical branches where customers can visit for in-person assistance.

While corporate banking caters to enterprises and huge organizations, retail banking concentrates on individual clients. Smaller transactions are handled by retail banking, whereas larger financial needs including trade financing, company loans, and treasury services are handled by corporate banking.

Retail bankers assist customers with their financial needs. They open accounts, process loan applications, provide investment advice, and address customer inquiries. They also promote bank products and services

Since retail banking makes a wide range of banking services accessible to a large number of individuals, it is important for financial equality. It ensures that essential financial items like savings accounts, payment services, and loans are available to everyone, regardless of income level.