Introduction to Wealth Management

Discover financial empowerment with Hunarho's Private Finance Essentials course. Designed to equip you with essential skills, this course covers a wide spectrum of topics. From personalized wealth-building strategies and investment insights to tax optimization, estate planning, and retirement readiness, you'll gain the knowledge and tools needed to secure your financial future.

Total Duration :

2 hours

Curated by Maxine Guerra & Joe Smith

Curated by

Mugdha Kulkarni

Instructor at hunarho

Free Certification

Enhance your concept understanding with certification

Self-Paced Learning

Learn at your own pace

Life Time Access

A learning investment forever

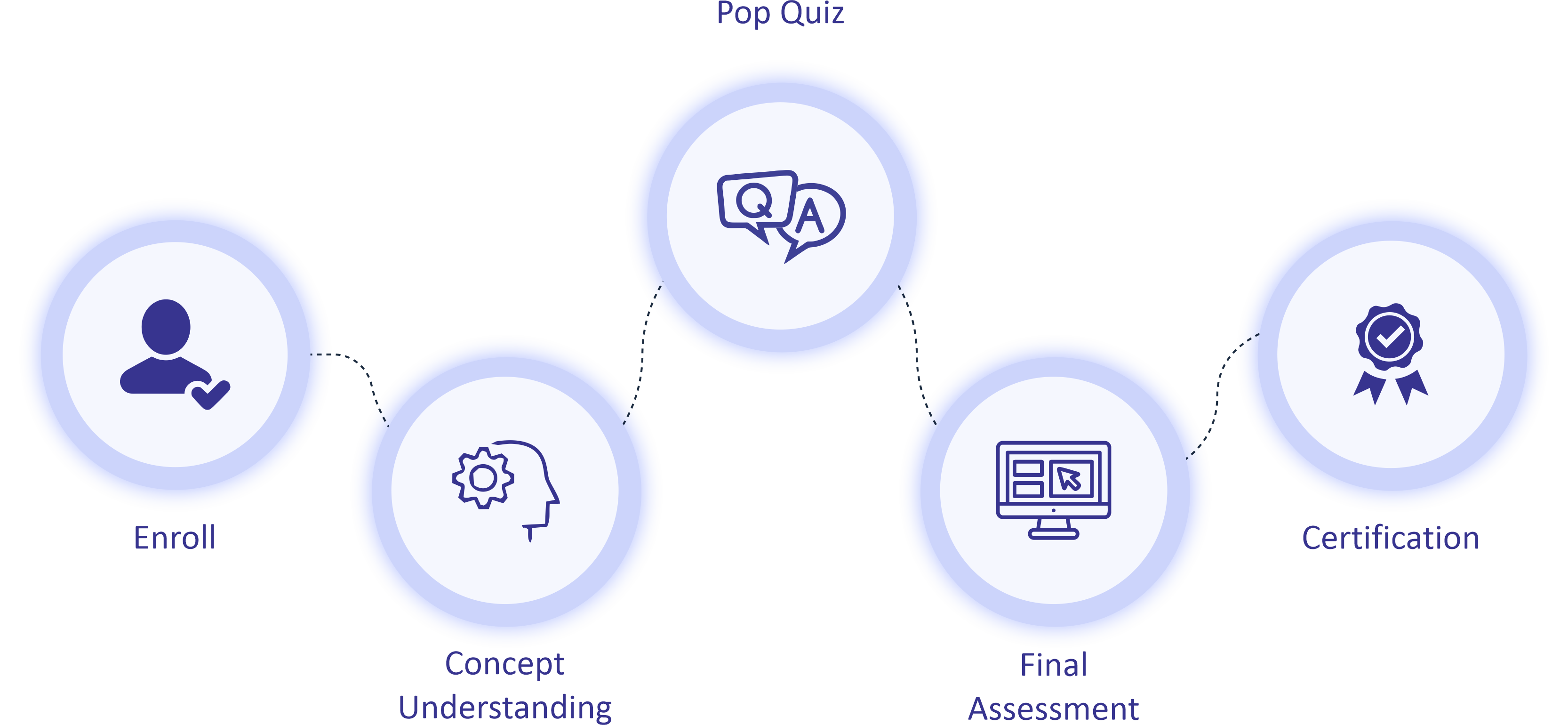

Hunar's Pathway To Success !

Course Highlights

Learn in-demand Skills from Industry Expert

Student Support

Mentorship

Mentorship for students

Solve Quizzes & Assignment

Exclusive Job Portal

Develop a Deep Understanding of Key Concepts

Live Masterclass

Packages at ₹35k/month

Get the best offers

Best-in-class content for the students from BFSI & Hunarho!

The learning path to the course

Module 1

Overview of Wealth Management

Introduction to Wealth Management

Private Wealth Management

Successful Financial Plan

Constraints in Wealth Management

Risk Tolerance

Drafting an IPS

Module 2

Important Concept in Private Finance

Power of Compounding

Future Value

Nominal vs Effective Rates

Present Value

Loan Amortization Schedule Using Present Value Concept

Perpetuities And Growing Annuities

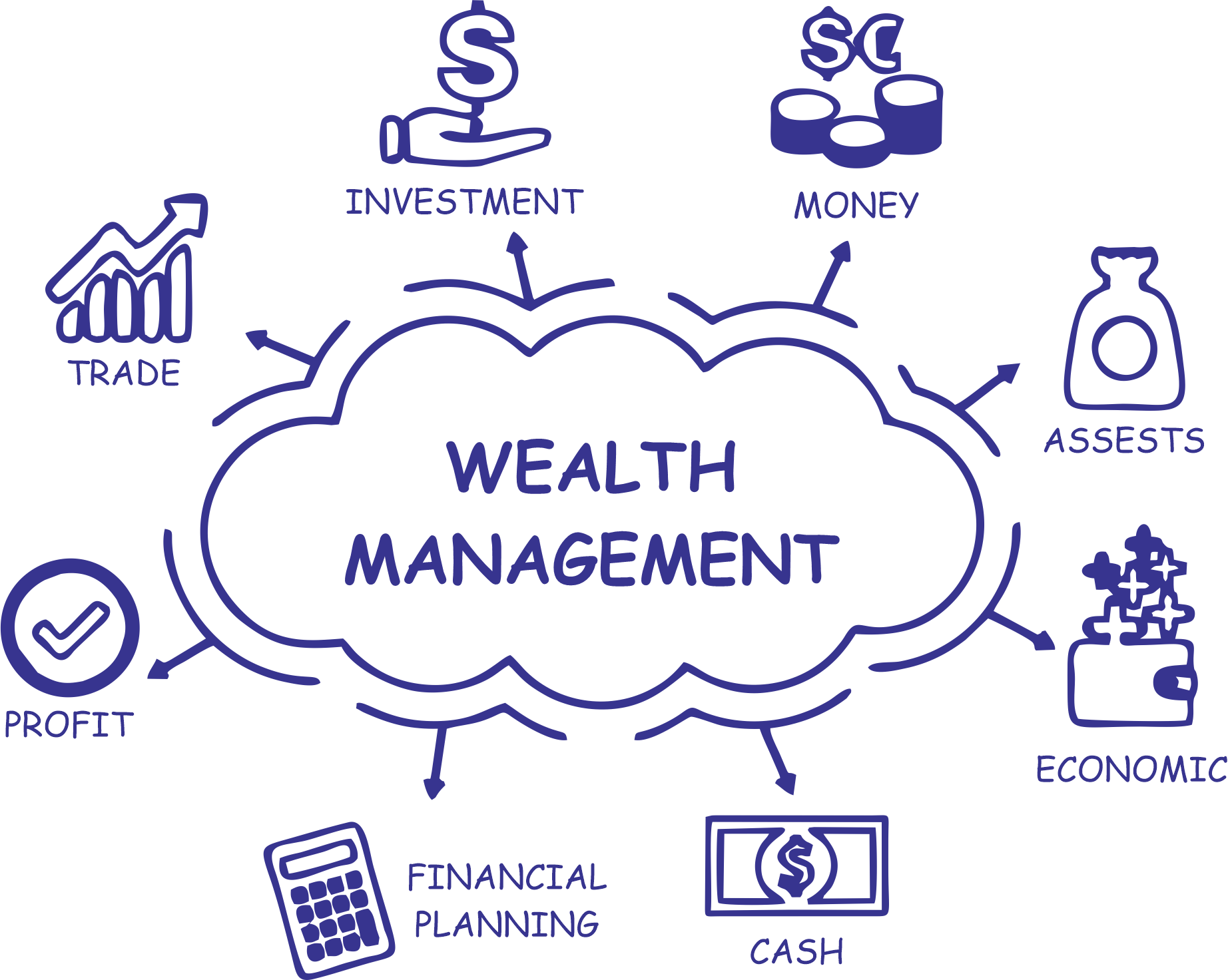

Why it is Important to Manage your Wealth Effectively

Wealth management is paramount for individuals and families seeking financial stability and long-term prosperity. It encompasses strategic planning, investment, and risk mitigation to secure and grow assets. Effective wealth management ensures financial goals are met, from buying a home and funding education to retirement planning.

Additionally, it offers protection against unforeseen economic downturns and emergencies, safeguarding against financial hardship. Proper management optimizes tax strategies, reducing the burden of taxation on accumulated wealth. Moreover, it provides a structured approach to legacy planning, ensuring assets are transferred seamlessly to heirs.

In a complex financial landscape, wealth management provides the expertise and discipline necessary to navigate markets, make informed decisions, and ultimately achieve financial peace of mind.

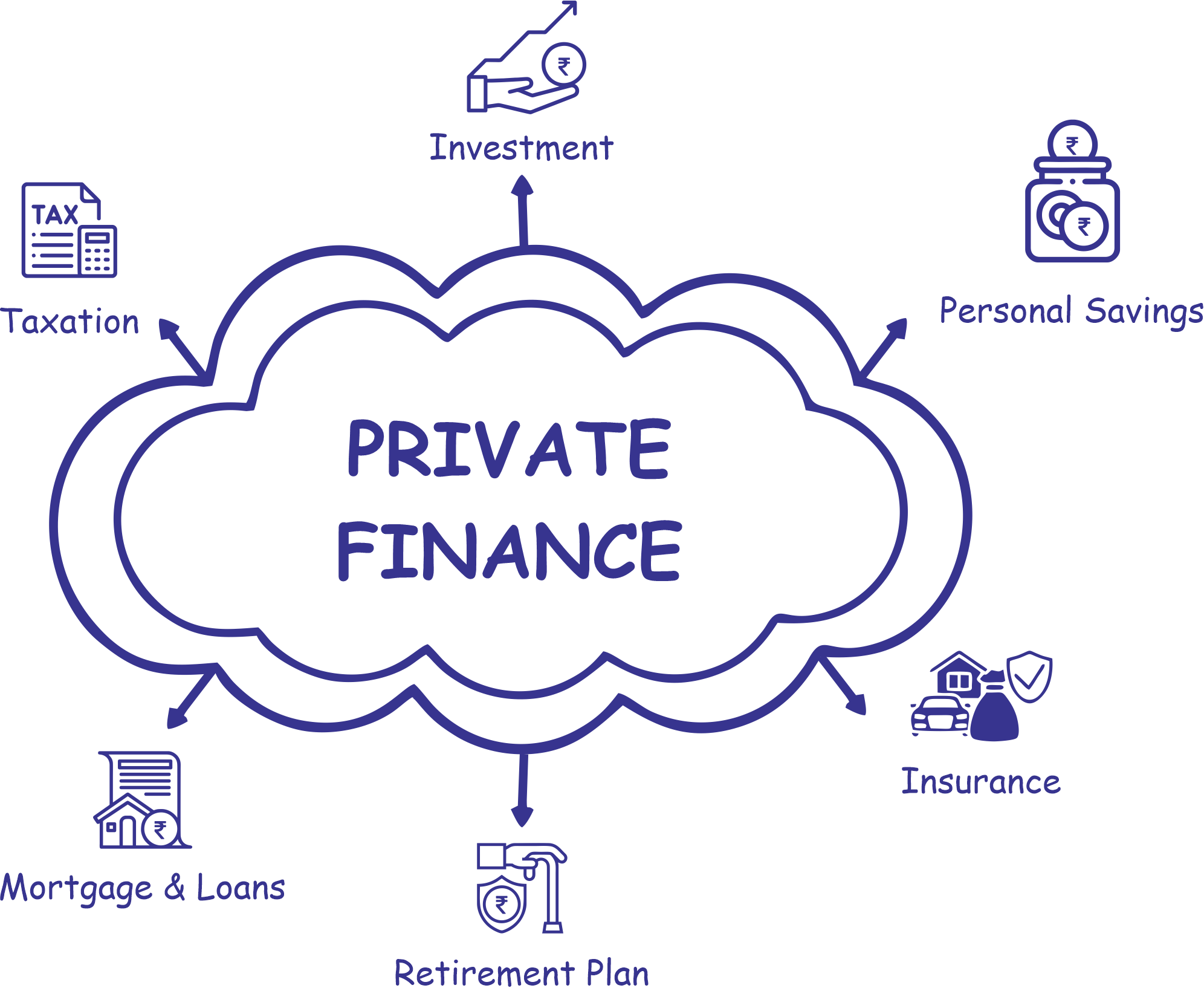

Importance of Private Finance

Private finance plays a crucial role in individuals’ lives by empowering them to take control of their financial well-being. It encompasses personal budgeting, savings, and investment strategies, enabling people to achieve financial goals like buying a home, funding education, or building a comfortable retirement nest egg. It also instills financial discipline, fostering responsible spending habits and debt management.

Private finance fosters self-reliance, reducing reliance on external sources of funding and helping individuals weather unexpected financial challenges. Moreover, it contributes to economic stability by bolstering personal financial security, which in turn positively impacts broader financial markets and the overall economy. In essence, private finance empowers individuals to secure their financial future and contribute to the overall economic health.

Industry Recognized Certificate

Share your certificate and gain visibility

- Demonstrate your skills & capabilities

- Acquire a competitive advantage

- Grab the attention of recruiters

- Take a leap towards your first job

Companies seeking applicants for Wealth Managers

Learners Support